Oil and gas project sanctioning set to exceed pre-COVID-19 levels from 2022

Despite devastated global oil and gas project sanctioning this year, Rystad Energy projects postponed plans will cause the total worth of final investment decisions to double next year and exceed pre-pandemic levels from 2022.

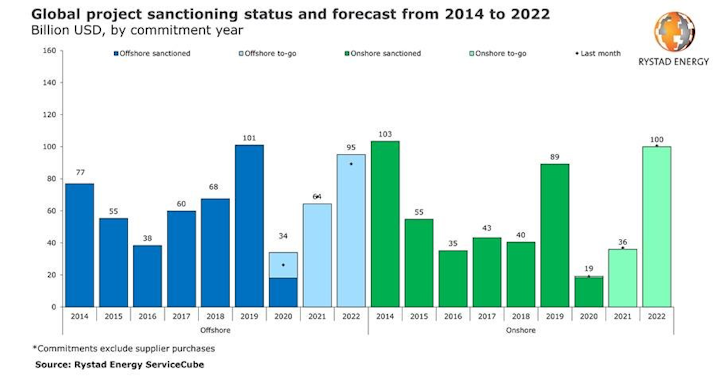

The COVID-19 pandemic has devastated global oil and gas project sanctioning this year and will cause total committed spending to drop to around $53 billion from 2019’s $190 billion, Rystad Energy projects. Postponed plans will, however, cause the total worth of final investment decisions (FIDs) to double next year and exceed pre-pandemic levels from 2022.

Offshore commitments are now expected to reach $34 billion in 2020, down from 2019’s $101 billion. Onshore sanctioning is likely to fall to $19 billion this year from $89 billion last year.

Rystad Energy estimates total sanctioning to bounce back to around $100 billion in 2021, primarily supported by offshore projects, whose value is forecasted at $64 billion for the year. Although lagging onshore projects are projected to only account for $36 billion in 2021, they will see a steep rise in 2022 to around $100 billion, topping the expected $95 billion worth of offshore commitments that year.

In this update, Rystad revised up its 2020 offshore sanctioning total to $34 billion from $26 billion, driven by the Mero-3 sanctioning in Brazil, which is estimated to cost $2.5 billion to first oil. MISC has a letter of intent in place with Petrobras for the charter of the floating production, storage, and offloading (FPSO). The contractor will subcontract the vessel construction work to Chinese yards, with China Merchants Heavy Industry (CMHI) leading the race to build both the hull and topsides. Siemens will deliver the power generation modules, while Aker Solutions is performing front-end engineering and design (FEED) and engineering work on the FPSO topsides.

Rystad Energy also expects commitments worth $3.6 billion related to the Payara development off Guyana in 2020. SBM Offshore is operating under an advanced commitment on the FPSO with ExxonMobil and its partners and the contractor has started procurement activities in collaboration with Chinese and Singaporean yards. The Chinese yard Shanghai Waigaoqiao Shipbuilding (SWS) is responsible for supplying the hull for the FPSO and the topsides will be built by Dyna-Mac and Keppel. FID is expected soon.

Before the oil price crash, Shell awarded a major contract to Sembcorp Marine for construction of the topsides and hull of a Floating Production Unit (FPU) for the US Gulf of Mexico Whale project. Uncertain economic conditions have forced Shell to defer the project FID to 2021. Whale has a breakeven of over $40/bbl. As the second wave of COVID-19 surges through Europe, America, and South Asia, it is uncertain whether the new development will start anytime soon, as the social distance norms and quarantine requirements will not only hamper the pace of development but could also lead to cost overruns, Rystad said.

Gazprom Neft started development activities on its Chayandinskoye oil-rim development in Russia. The well construction program is under way and the expansion of the existing central processing facility at the main field is likely to start soon. The onshore development is estimated to cost around $1.3 billion and the field is expected to come online by 2022.

Recently, the Norwegian Ministry of Petroleum and Energy approved the plan for development and operation (PDO) of the Balder Future project. The partners, Vaar Energi and Mime Petroleum, submitted a revised PDO in December 2019 and selected preferred contractors. The $2 billion development plan includes an upgrade of the Jotun FPSO vessel which will operate between Balder and Ringhorne fields. The FPSO is being upgraded by Worley, while Baker Hughes and Ocean Installer are responsible for supplying the subsea facilities.

Lastly, China Offshore Oil Engineering Co. (COOEC) confirmed the start of development activities on CNOOC’s Luda 6-2 oilfield off China in its second-quarter results. The Luda 6-2 development will entail a central processing platform and is estimated to cost nearly $170 million in greenfield commitments. Production is likely to start in early 2022.